BOJ QE + Raises 10Y Ceiling 25Bp

Overnight early on in the Asian session the BOJ made some bold moves, deciding to purchase more bonds and set the rate of their 10Y control band to +/- 0.50%:

The BOJ said it will sharply increase bond buying, a sign the move was a fine-tuning of its existing ultra-loose monetary policy rather than a withdrawal of stimulus. -Reuters

This news sent equity and bond markets sharply lower but have since recovered some of those losses. This move is positive for Japanese banks in regards to increasing Net Interest Margins and should see bank shares improve. However this doesn’t remove the idea that global markets are slowing and the move by the BOJ in regards to buying more bonds is perhaps they understand QE will have to continue, much like it will for the rest of the global central banks.

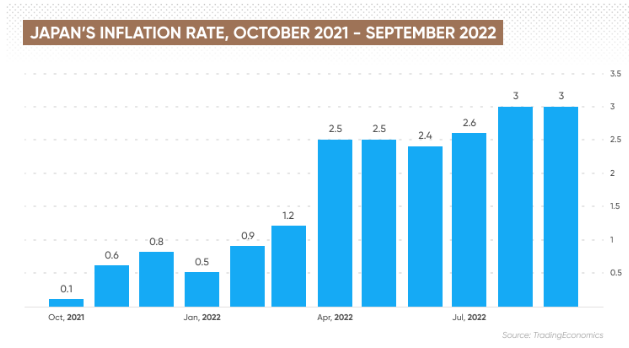

In regards to Japanese inflation, this move was most likely a response to the 3% domestic inflation they have seen over this year, which is 1% above their target rate.