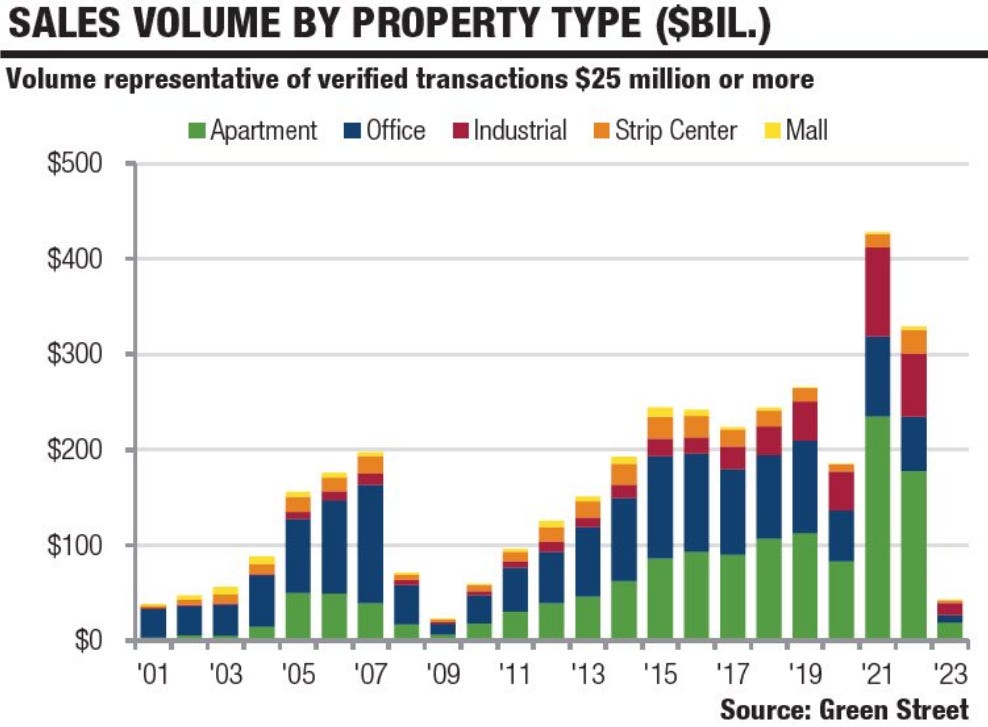

CRE Volume Craters & NQ Hits 0.786 Fib

Let’s start off today’s note with this nasty CRE chart:

This is an absolute total volume collapse. This is stagnant supply and a massive reduction in the velocity of CRE turnover. This is a duration extension that will eat up a lot of excess capital for some major investors and will also lead to a reduction in prices and most certainly an increase in cap rate expectations. Money is not moving and this is what deflation looks like. Not to mention the massive amounts of debt that needs to be refinanced at what 2x, 3x rates of today? This is a big deal and we must keep a diligent eye on this!

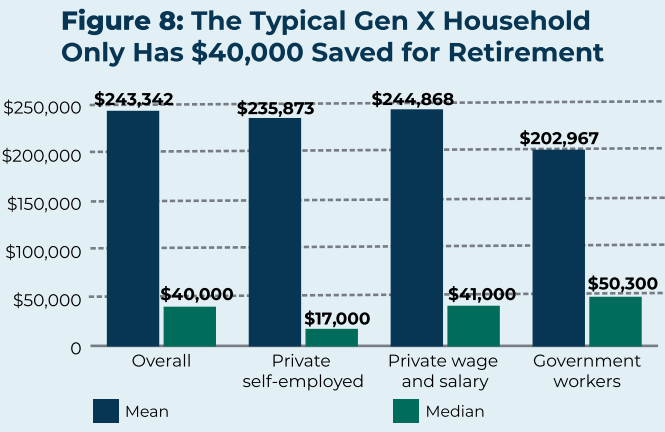

We also saw a Zhedge article today about the lack of long term savings form the GenX crew, and they posted this chart:

What this tells us is that the massive monetary inflation has led to a generation that is struggling to get by and barely break even. What this also tells us is that despite this lack of longer term savings, that this generation does have a massive call option, not everyone but a good majority we surmise. What do we mean, well each one of the GenXers are a product of a BabyBoomer, and as Fortune Magazine wrote last December,

The GenXers are also potentially sitting on a $53 Trillion windfall from their predecessors and this is what we mean by an asymmetrical call option on their future.