GDP +2.6% Quick Morning Update

Technical Charts and MBS quick lesson

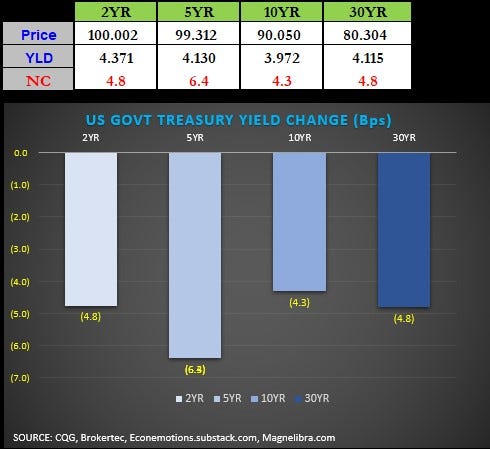

Markets were pretty much unchanged to a bit lower across the board coming into early NY trade in fixed income land and the Nasdaq continues to be the weak link in equity land. Seems like a few players were waiting to buy US Treasuries till after GDP print which was 2/10ths higher than expected and bonds were straight up from there. Its also good to note that the GDP price index rose 4.1% well below the 5.3% expectation. Here is a quick peek at the US Treasury market right now, as yields are down across the board:

We read a decent piece on MBS (Mortgage Backed Securities) yesterday and the forced selling that has occurred for the better part of this year in regards to hedging duration. Its a complex situation for novices, but just to put it into a more fundamental perspective, all you need to know is that if you own MBS and rates rise rapidly, your duration (holding period or rate sensitivity) grows thus you need to hedge by selling futures or cash equivalent products (rates up/price down).