Ignoring the Warning Signs for Now

What we are currently witnessing across global financial market places is that there seems to be this sort of wishful thinking that central bank QE programs will once again create the environment for leverage and credit expansion.

It is apparent in the resiliency of the equity markets in the face of all this global banking fallout that equities have simply shrugged this all off, or have they?

We know just a very few, very large players dominate the flows and it is within these players that constant support comes and is derived from access to continued funding. It is well documented and should be of no surprise that the SP500 follows the FRB balance sheet and when it expands we move higher when it doesn’t we fall or stagnate. So what gives considering the recent banking turmoil which we know the global bond markets are screaming that things are far worse under the hood that the central banks want you to believe?

Perhaps the global bond markets have bid up short duration securities because of the real risk, but perhaps that the global bond market players have just forced the hands of many smaller players to capitulate on those flattening bets which caused massive inversions across global bond markets just a short while ago.

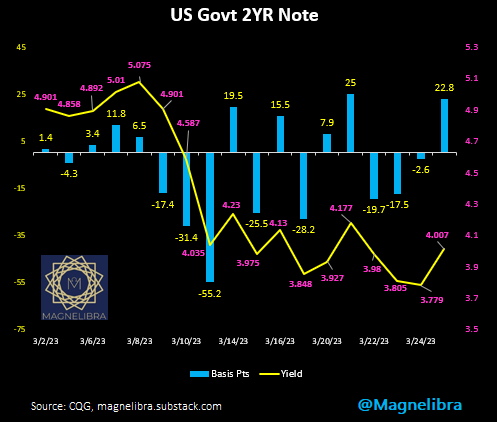

We saw this a few weeks ago when the flattening was pushed to record inversions as the US Govt 2YR hit a yield of 5.07%, to only be wiped out the other way as the US Govt 2Y yields plunged over 130 basis points, now sitting at 4.00%:

That is a massive unprecedented move and smells of forced short end buying. We aren’t suggesting that the yield curves are not correct in thinking there is more pain ahead for the global economy and that the global central banks have gone too far too fast. Rather we are suggesting that the speed by which these moves have transpired, are due for some back and forth collective battling via market participants.