Thank you for joining us for another edition of the Magnelibra Markets Podcast, I’m your host Mike Agne and today’s episode #10 is entitled “Non Farm Payroll Day is Here!”

Here is the calendar of data for tomorrow and obviously employment report is the highlight of the day where the expectation is for a rise of 170k jobs. We are going with the under on this one and suspect the bond market will rally if it does indeed come in below this number and equities may rally as well given they might be in the camp of bad news is good news due to the rate cut scenarios:

We don’t want to forget that we have ISM services as well and that could move us also, so make sure you are aware of that data point as well. All in all the FOMC is going to get their first big data print which should signal whether or not we are closer to our first rate cut or not.

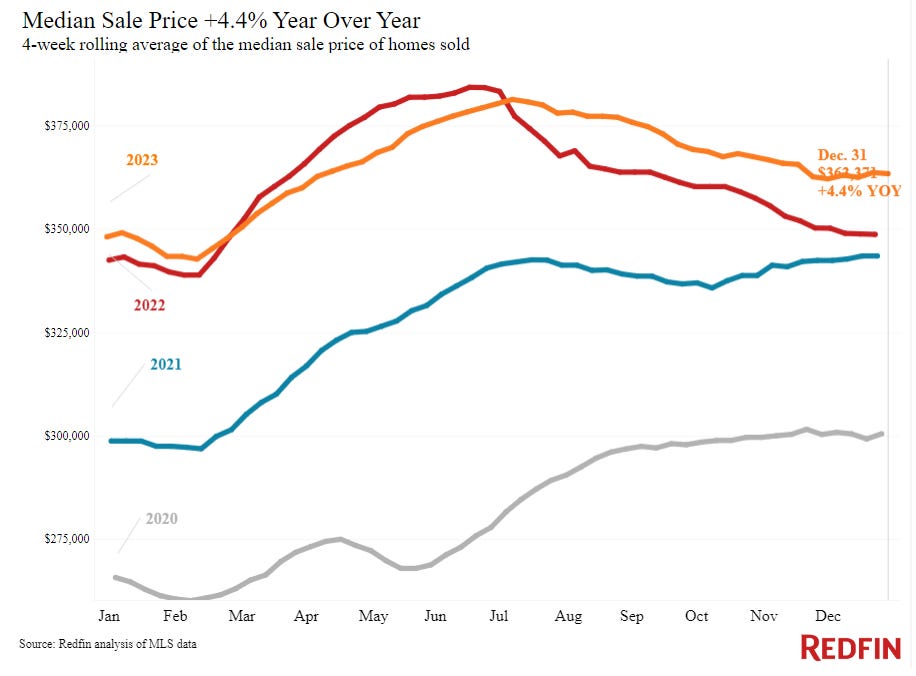

We have a couple of other items we wanted to share before we get into todays settles and trackers, let’s start with the Median Home Sales chart from Redfin:

What this shows is that the median sale price was +4.4% YoY, which really isn’t a surprise considering the absolute lack of supply across 2023 available for sale. Another data point we want to point out is the prior 4 years starting level. This is a direct result of DC and FOMC fiscal and monetary stimulus. The money that gets plowed into the economy no matter whose hands it starts in, ultimately ends up in the top 1% coffers. The money accumulates to those who need it the least because they are not bound by the natural laws of economics like the bottom 80%. Inflation does not effect everyone equally. We have said it time and time again that monetary printing leads to ever increasing asset prices, whether its equities or real estate. So from 2020 till now we can see the starting point rise from $260k to $348k an increase of 33.8%. This is a direct result of the $6T in stimulus, nothing more. These are new plateaus that raise the cost of shelter for everyone and not just home purchases but rentals as well.

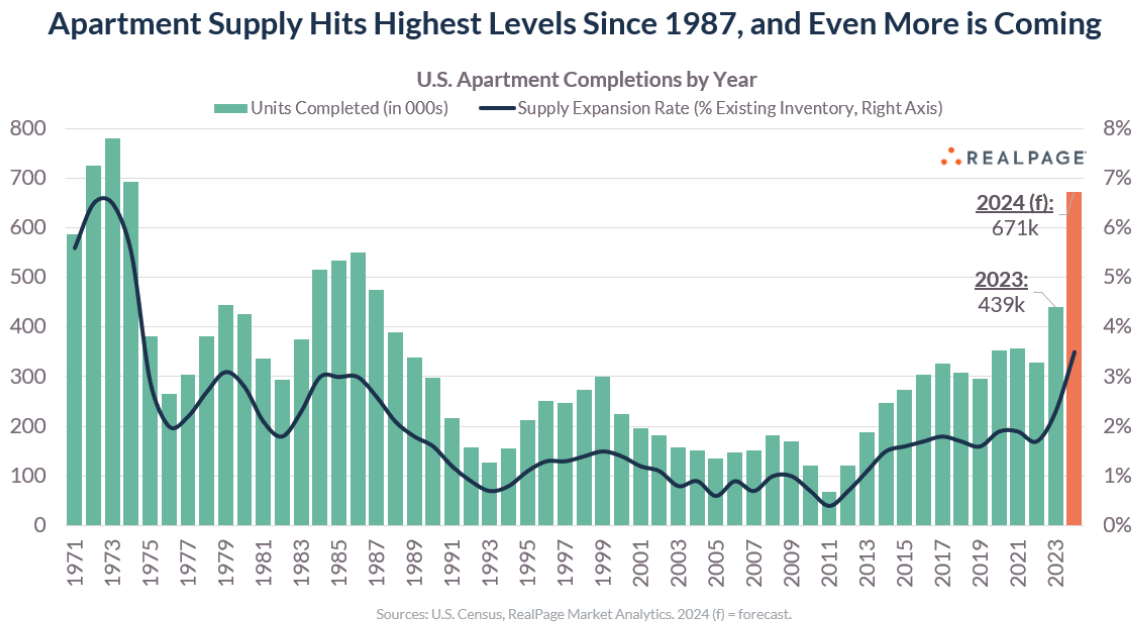

One good thing we see is that prices are not accelerating and we suspect that if rates do fall that prices will collapse due to the overwhelming supply of homes that will be dumped onto the markets. Not to mention the recent data is showing a massive amount of new supply coming to market now in the apartment sector, so this is indeed good news for consumers. This chart shows that we are hitting multi decade supply expansion rates:

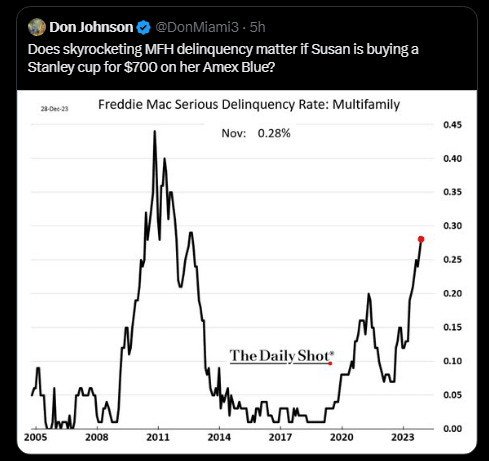

Our final data point and sticking with the housing theme is that Freddie Mac delinquency rates on multifamily are now at levels not seen since 2013, @DonMiami3 shared this chart on X:

Slowly we are seeing the sellers market turning into a buyers market and once rates drop this will become even more evident!

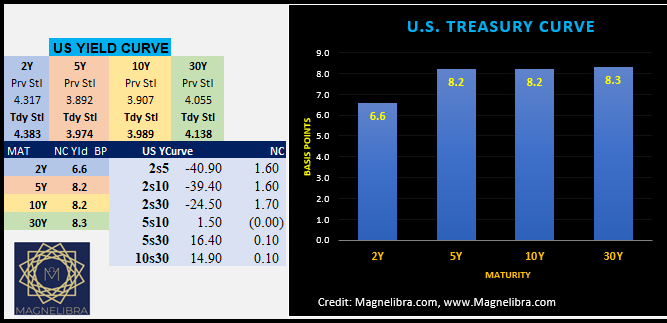

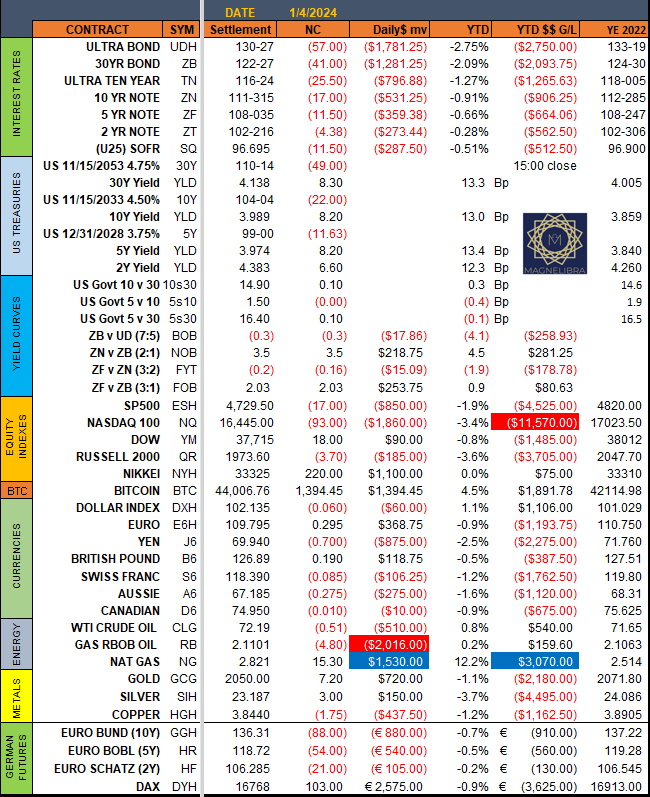

Ok on to today’s settlements the bond market continues to get hit and we saw another parallel shift in the US yield curve today as the 2s were +6.6bp and the rest of the curve 5s on out were +8.2bp or so respectively:

When we look at the settlements in the other markets we follow the Nasdaq was lower again down 93 points, with Nat Gas the winner once again today +15.30:

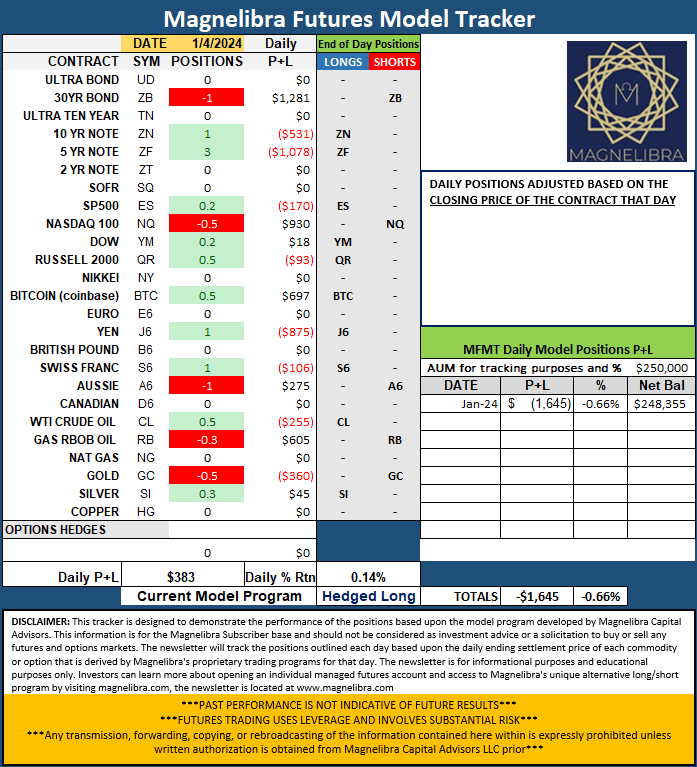

As far as our Magnelibra Futures Model Tracker, no changes across the board here:

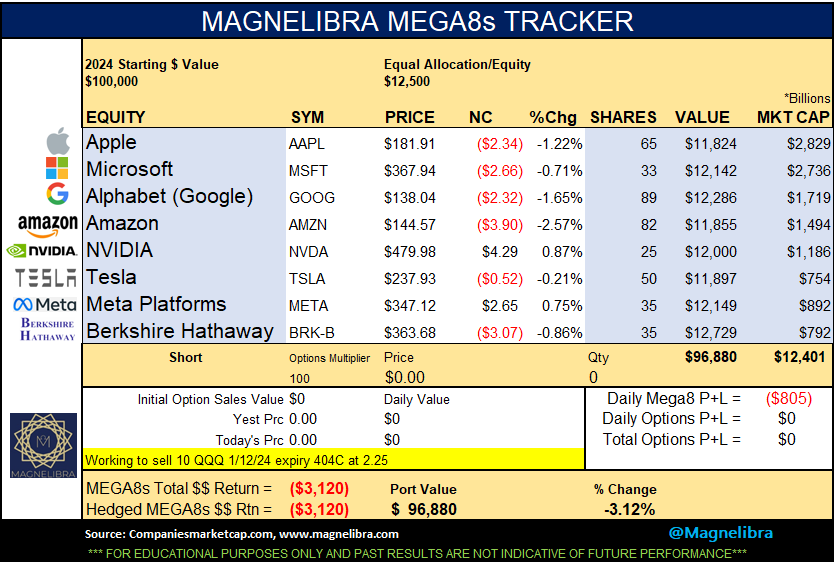

As far as the MEGA8s the sector continues to lose marginally and the package is now down 3.12% on the year. We will continue to work that 404C at 2.25 as a hedge to this group and we will need a rally tomorrow in the QQQs to get that off. Remember this group has $12T market cap support and we are $400bn away from that, so still some room to go before some really panic selling may ensue:

Ok we hope you got a chance to read this mornings post, if you aren’t a subscriber we hope that you find our content good enough to support. We figure that the knowledge that we provide, the insight we unlock is worth the price of admission! 82 cents a day is not a tall order, in fact we value our data and insight at a much higher level than that but we owe it humanity to provide clarity and understanding for topics that truly effect everyone in one way or another.

Thank you to each and everyone of you and remember 2024 is about positivity, let’s always try to focus on the positive and let’s see if we can shape our reality together! Till next time…Cheers