Thank you guys for joining me and welcome to Episode 9 of Season 2 brought to you by Magnelibra Trading & Research (MTR). This episode is entitled “PCE Inflation Flat & Apple Earnings”

Quick Disclaimer: The following podcast is for educational purposes only. This is not a solicitation to buy or sell commodity futures or options. The risk of trading securities, futures and options can be substantial and may not be appropriate for all listeners.

This morning we saw the PCE inflation numbers and were quite sure this is what the FOMC was expecting. You guys know we peg the real inflation rate over the last 25 years has been 3%, so the FOMC isn’t fooling us, this is their real target rate. Here are the PCE numbers from this morning, Core was +2.8% YoY (unch MoM). Headline was +2.6% as expected. We know Super Core Inflation is sticky and is expected because peoples habits don’t really change that much or that fast and the services sector won’t be impacted as quickly. Now if we start to see joblessness rise and the economy deteriorate, well we would expect SuperCore to begin to fall.

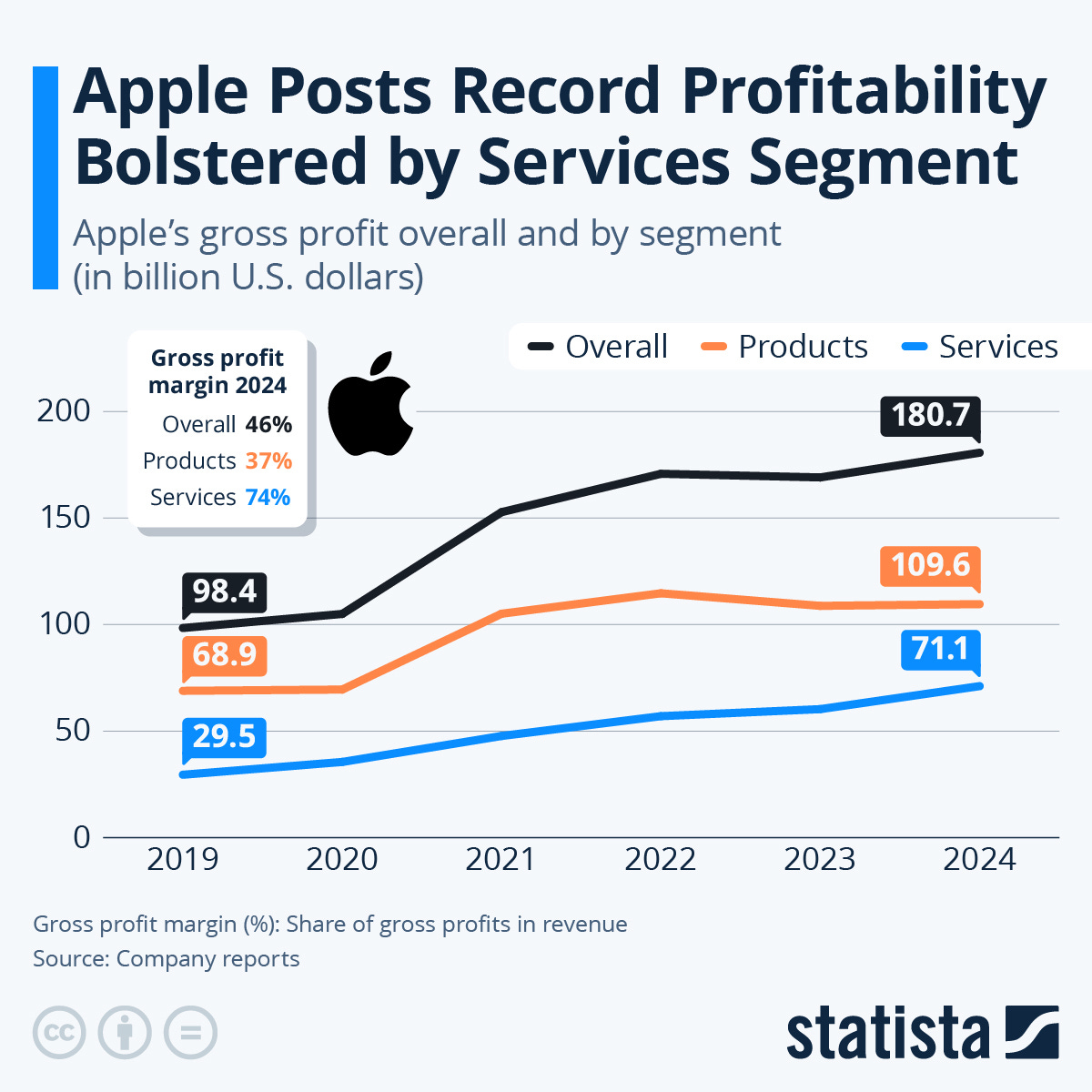

Ok so the next important topic is Apple. Apple beat EPS estimates of $2.35 by posting a $2.40 number. Revenue was $124.3Bn which was a beat but if you compare that to Q1 2022 its essentially flat. When you discount this value via an average of 3% inflation over the last few years, well that number is actually about $12Bn less. Apple’s services revenue which continues to grow hitting a record $26.34bn +14% YoY. So yea nominally Apples best quarter ever +4% YoY, but as we showed, discounted for inflation, well its not really that impressive:

Apple initially spiked after hours but today’s session is putting a lid on the euphoria. As we noted in our update yesterday, we expect the market makers to defend that $240 level and a close below there would be in their best interest. Well here is the daily and wouldn’t you know it after posting a high up near $248 we are right back just below $240:

This weeks range in Apple is consistent with its higher trend channel that it has been carving now for over 7 months:

Ok as far as the indexes the SP500 and the Nasdaq futures have pretty much stayed smack in the middle of their longer term weekly ranges. The SP500 is actually technically in a stronger position with the weekly closing above 6042 barring some drastic late day sell off today:

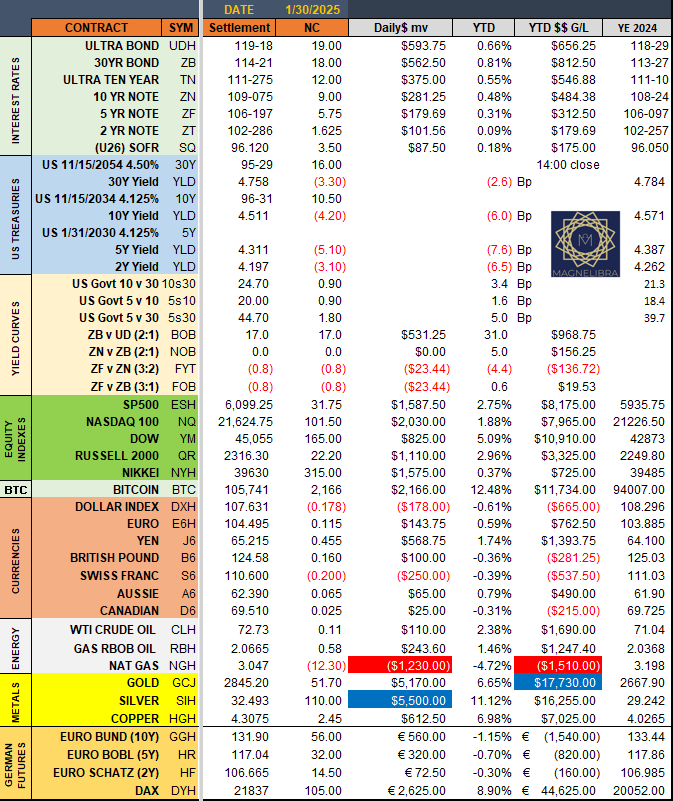

Another bull chart that is impressive is April Gold, wow super strong here and now the bulls support continues to rise, with $2731 now the bull level to hold:

Ok lets look at the US bond market, here is the US Govt 10Y which is desperately trying to roll over and move to a more lower yields trajectory. We like the pattern technically and it does look like a move below 4.37% would add to a nice bull case for bond prices to rise and yields to fall:

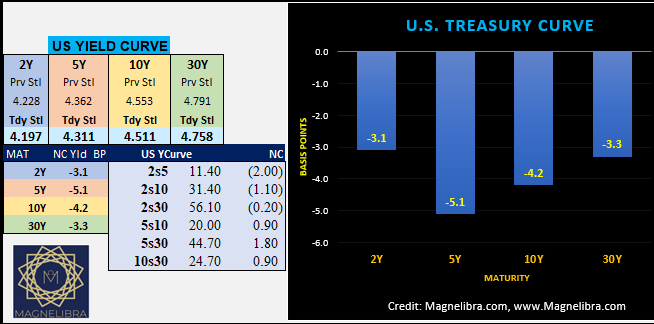

As far as yesterday’s bond market and its yield curve settlements the 5y was the strongest sector dropping 5.1bp:

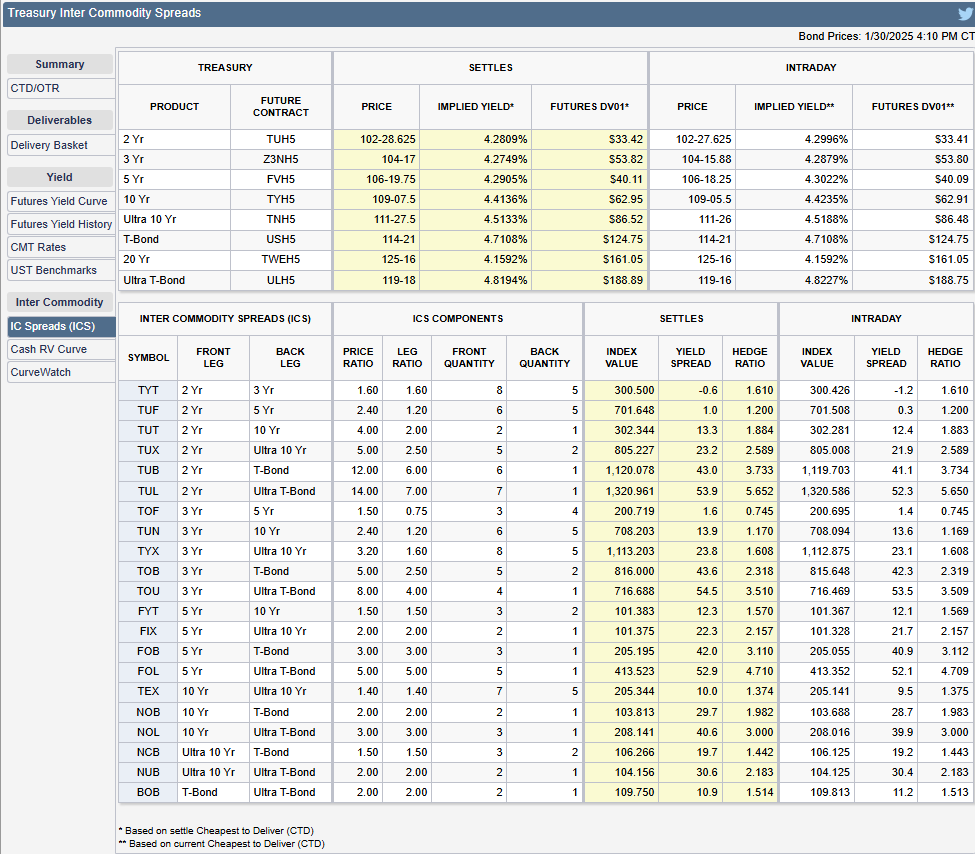

We also wanted to share this CME Group InterCommodity bond market spread data. This is an important tool for bond traders because what it shows is that it gives you the appropriate spread sizing, which is based off of each contracts Dollar Value of 1 Basis Point or DV01. Now this is not for your novice type trader, but this data is integral for anyone using bond spreads or trading bonds to understand the contract differentials. One could get into a lot of trouble by trading these products and not understanding these values. So we wanted to share this data for our viewers and listeners:

We have over 25 years experience in this arena and I have traded billions of dollars worth of US Treasury bonds as a bond arb. I loved this game, I was excellent at this game and early on in my career it allowed me to generate massive profits for many years. The kind of profits generated and the consistency and risk adjusted returns were truly unfathomable. I consistently made money 18 out of 22 days every month. This was arbitrage, in and out and calculated risk. My mind just understood it, I learned and was mentored by 2 very good cash market traders and it all just clicked. I was lucky, I was lucky to get the opportunity and honestly I can’t tell you why I did so well, only that among all the chaos, I simply just understood it. I had a passion for markets, for numbers, for understanding relative values and my success early could be directly attributed to this passion.

I mentored many traders in my day and I consistently told them and emphasized that success is a culmination of your understanding and respecting both money and risk. My traders often asked me, how I made so much money, and my answer was always the same, I never looked at the markets as money, it was a game, I was good at it. I learned to never force any trades, to take what was there and the biggest thing I learned, if I was wishing something would go my way, I was unprepared and should exit right away! Intuition helps, understanding helps and a fear of loss is a traders worst enemy. I often said if you are going to focus on the money, then set a goal, reach it and quit. Quite often I told them that I would get in at 6:30am and by 9am I reached my goal. I was done, I quit for the day and did something else, if I was there past the 2pm cst. close, then 100% of the time that day was a loss! Trading is hard, its difficult, sometimes impossible, but sometimes in life you come across an opportunity and that opportunity is your chance, you have to run with it. Nothing in life comes easy! Ok maybe I will share more war stories in upcoming episodes but for now lets get to the trackers:

yesterdays settlements:

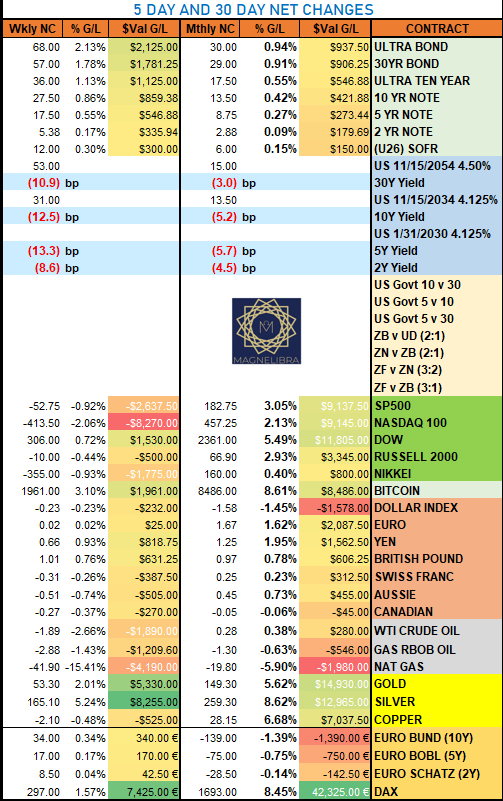

5 and 30 day net changes:

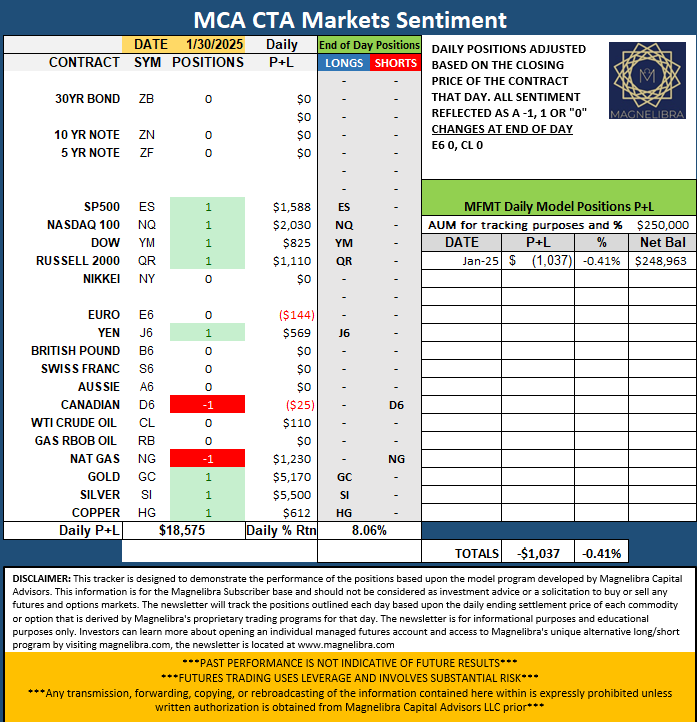

As far as the MCA CTA Markets Sentiment indicator the Euro and Crude moved to Neutral:

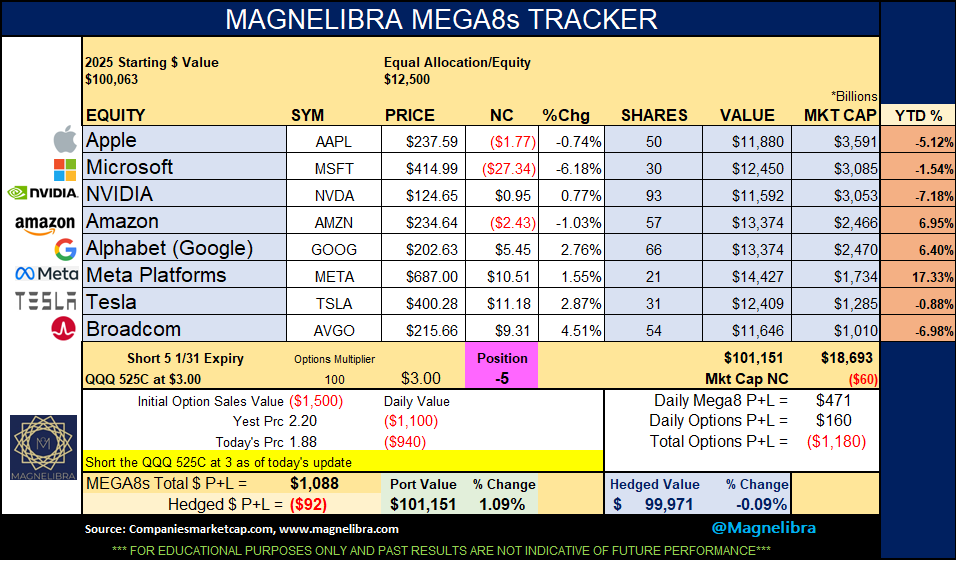

MEGA8s were pretty much unchanged as a group but MSFT was hammered -6.1%:

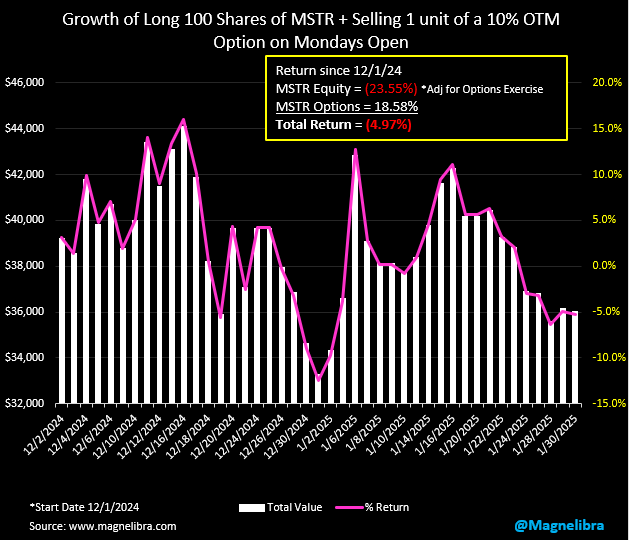

MicroStrategy data:

Thank you everyone for joining us today, we wish you a very pleasant weekend, maybe try something new, something uncomfortable that is where the most growth comes from! Try to take the viewpoint that no matter what happens it is a good thing, we can go one of two routes, the right way or the wrong way, one path has promise, the other despair, so please for the collective good always try to opt for right path! OK Remember to hit that subscribe button and support our work, give us a like or share our work if you can. Ok guys, till next time, cheers.

Support directly to our BTC address:

3DvDvPnjwu5Fd6sagAYmiFXA2fPkjJf2cp